|

Inner-city apartment prices could be affected by a wave of new properties coming onto the market at the same time as some off-the-plan buyers struggle to settle on their purchases, Standard & Poor's says.

The credit ratings agency has highlighted fears of an oversupply of apartments in Melbourne and Brisbane especially, alongside "settlement risk", caused by tougher bank lending rules. Despite the commentary, which comes after the Reserve Bank warned about the risks to bank loans of property developers building apartments, S&P said it did not expect an increase in home loan defaults. Reserve Bank figures, published on Tuesday, also showed further slowing in housing credit growth in the year to April, led by weaker growth in lending to investors. Amid an apartment building boom in many of Australia's biggest cities, S&P analysts said in a report published on Tuesday that the balance between supply and demand for property, appeared to be narrowing, especially in the apartment market. "There is growing concern over the large volume of new unit stock coming onto the market, in addition to the already-existing supply, particularly in inner-city postcodes. This is more pronounced in Melbourne and Brisbane," the S&P report said. Settlement risk increases The new units will be coming onto the market at the same time as banks have tightened their lending to property investors, especially those from overseas and buyers of high-rise apartments. Many banks are requiring investors to stump up bigger deposits, which raises "settlement risk" if off-the-plan buyers had assumed they could get a bigger loan when they put down their 10 per cent deposit. "This is of particular concern for off-the-plan developments, which have a lag between the contract being signed and final settlement. Property prices could be affected, particularly if new units coming up for settlement are in competition with existing supply," S&P said. Moody's also said last week that settlement risk had increased because of a fall in inward investment in residential property from China. Westpac, ANZ Bank, Commonwealth Bank and National Australia Bank have all in recent months tightened or stopped lending to overseas buyers, who tend to be big buyers of off-the-plan apartments. Banks also cracked down last year on lending to domestic property investors, in response to the Australian Prudential Regulation Authority's 10 per cent cap on housing investor credit growth. Figures from the RBA on Tuesday showed housing investor credit growth slowed to 6.5 per cent in the year to April, from 7.1 per cent. ANZ Bank economists said the slower growth in mortgage lending would be welcome news to officials who had been concerned last year about the market overheating, especially as the May interest rate cut was likely to stimulate the property market. Mortgage risk Lending to owner-occupiers rose to 7.3 per cent, while business credit also strengthened, lifting to 7 per cent, its quickest annual pace since early 2009. The Reserve Bank also said in April there was potential for banks to make "large losses" from soured loans to property developers, amid concerns of a looming glut of apartments in parts of Sydney, Melbourne and Brisbane. Even so, the latest round of financial results showed low levels of mortgage stress, despite some lift in troubled loans in mining areas. S&P's report, an annual overview of the market for mortgage bonds, which lenders issue to raise money, says the proportion of mortgage borrowers falling behind on their repayments has drifted higher for the past five months, especially in mining states Western Australia and Queensland. The rise in arrears was the result of mining workers moving into lower-paid jobs, it said, adding that as the jobs market was "relatively stable" it did not expect higher arrears to translate into a rise in mortgage defaults. Source: The Sydney Morning Herald by Clancy Yeates

0 Comments

The introduction of new legislative changes on property sales over $2 million will create a new compliance burden and could delay property settlements, according to national accounting and advisory firm William Buck.

On the 1st of July 2016 the new legislation will come into effect under The Tax and Superannuation Laws Amendment Bill 2015. It introduces a new 10 per cent withholding obligation on the purchasers of properties over $2 million where the vendor is a foreign resident for tax purposes. Sellers are also now required to obtain a clearance certificate to prove they are an Australian resident for tax purposes. According to data from APM Research and the Australian Bureau of Statistics in the 2016 FYI (up to 31 April) there were 12,072 house and apartment sales in Australia over $2 million. Manda Trautwein, Director at William Buck comments, “The legislative changes will put Australian and foreign residents on a level playing field, but will have their challenges. The tax compliance burden for resident taxpayers will significantly increase and conveyancers will need to ensure their clients are abiding by the new laws to limit property settlement delays. “The Federal government is expected to significantly benefit from the new changes as there should be less tax revenue leakage. “From a buyer’s perspective they now have an obligation to withhold 10 per cent of the property price to ensure the purchaser is compliant with the new regulations, otherwise they could be liable to pay a penalty which is up to the full 10 per cent of the purchase price plus interest. “From a seller’s perspective, they could have less funds available which might otherwise have been available to discharge the mortgage on the property and/or fund a new property purchase. They could end up with only 90 per cent of the proceeds on settlement unless they are able to obtain a clearance certificate from the tax office. If there are data irregularities, delays of between 14 to 28 days are expected to obtain a clearance certificate. “The legislative changes were introduced to reduce difficulties that can be associated with collecting tax on gains resulting from the sale of property assets from foreign resident taxpayers. Some of these tax payers have a limited connection to the Australian tax system and may be in a position to transfer proceeds offshore prior to compliance action being taken. Voluntary compliance by foreign residents in this regard is said to be extremely low.” The ATO is yet to release forms for the following: clearance certificate application for Australian residents; variation application for foreign residents and other parties; purchaser payment notification. Source: The Urban Developer The unpleasant fallout from hitting the wonderful Chinese apartment buyers who could fail to settle18/5/2016 Robert Gottliebsen, the Business Spectator columnist says the Chinese have suddenly turned their back on the Sydney apartment market, with Melbourne and other markets set to follow.

"We are hitting our largest trading partner with an unprecedented series of blows at a time when they are undergoing fundamental change. "We had better brace ourselves for the consequences because they will not be pleasant." The new foreign capital restrictions in China, will effectively block them completing their Australian off the plan purchases. "Vast numbers of Chinese purchases are in danger of lapsing. "If that happens, it will send property developers to the wall," he wrote. A halving in Chinese and other foreign buyers in the Sydney apartment market was suggested last week by Sydney’s largest apartment developer Meriton’s Harry Triguboff. As Harry Triguboff has repaid all his debts, he is still able to fun the Chinese “off the plan” purchases, but few other developers have such a balance sheet to fund the purchases. Gottliebsen noted Chinese buying of apartments was one of the biggest forces that enabled Australia to avoid going into recession following the dramatic decline in mining investment. "If the current dramatic decline in Chinese apartment buying continues, in the absence of some other offsetting factor, it could easily lead to a recession in Australia. "Australian bank profits are not in the front line of vulnerability but they will be hit." He also noted the Chinese are now making it much harder for their nationals to take money out of China. "Nevertheless, Chinese nationals can normally get a 10 per cent deposit on an apartment out of the country — although sometimes it can take credit card gymnastics. "That means they have the required deposit for an ‘off the plan’ purchase and they can normally get another 20 per cent out of China on settlement so that they have a 30 per cent deposit when the apartment is completed. "Previously, they could get the remaining 70 per cent required on settlement out of China. "Now that’s much harder. "Just when the Chinese are under pressure, at the urging of APRA, the big Australian banks have lowered their loan to valuation ratio from 70 per cent to 60 per cent and have stated that they will no longer recognise self-employed income from overseas." He suggested that the Chinese have been wonderful borrowers. Source: Property Observer by Jonathan Chancellor There is a growing risk that new apartment buyers will not complete their purchases due to a high-rise glut, falling prices and a drop-off in foreign buyers.

Key points:

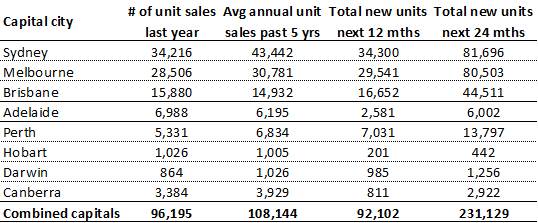

Australia's apartment building boom is yet to pass its peak, with analysts at CoreLogic RP Data predicting that the peak of apartment completion will not be reached until next year. Over the next 24 months, CoreLogic expects 231,129 units to be completed, which compares with average annual unit sales of 108,144 over the past five years. This means that there will be almost 14,000 units built in excess of typical demand in any given year. This may not sound too dramatic, but CoreLogic researcher Camron Kusher points out that the unit sales figures include both new and existing, and new stock usually accounts for a smaller slice of sales than existing. "The large volume of new stock, coupled with an ever-growing supply of existing stock, means that historic high levels of unit settlements are due to occur over the next two years in most cities," he noted. "In fact, even a recurrence of the peak year for sales in Melbourne and Brisbane over the next two years wouldn't represent enough demand to cater for all of the new units set to settle over the coming 24 months." Melbourne, Brisbane, Sydney apartment surgeThe inner-city areas of Melbourne (14,353), Brisbane (10,189) and Sydney (9,376) are set for the biggest supply of new units. Brisbane, Sydney and Melbourne also have the most suburban apartments due for completion over the next two years. Most of that new stock in Brisbane and Melbourne is within 10 kilometres of the city centre, while Sydney's apartment boom is more geographically spread. This glut is expected to put significant downward pressure on prices, meaning that many people who have put down deposits will find their units worth less when it is time to settle than they were when the initial contract was signed. This may lead some to walk away from their deposits voluntarily, or be forced to because they find their bank will only lend them an amount based on the current, lower market value. Bank crackdown on foreign buyersAnother significant group of buyers is also likely to face difficulty getting sufficient finance to settle. Foreign buyers currently make up an estimated 12 per cent of new home sales, and many of them have been getting finance for their purchases from local banks. However, all four major banks, and many of their rivals, have significantly tightened lending criteria for non-citizen/non-permanent resident borrowers. Westpac has gone as far as an outright moratorium on lending to overseas buyers, although temporary residents can still borrow money (but not for vacant land), Australians with non-resident spouses cannot get a loan. For those earning foreign currency income who are still eligible to get a loan, they are only able to borrow 70 per cent of the property's value. ANZ has a blanket ban on loans to people who earn 100 per cent of their income overseas and a maximum 70 per cent loan-to-value (LVR) ratio for those who earn more than half their income overseas. The Commonwealth Bank is no longer accepting self-employed foreign income and has reduced the maximum LVR for temporary residents from 80 to 70 per cent. NAB capped out the big four this week, with a 60 per cent LVR on foreign loan applicants as well as only counting 60 per cent of foreign income in loan serviceability assessments. In addition, Citibank has restricted eligible currencies for foreign borrowers to count towards serviceability requirements as Canadian dollars, Danish kroner, euros, Hong Kong dollars, yen, New Zealand dollars, Swedish kroner, Singaporean dollars, South Korean won, Swiss francs, British pounds and US dollars. These restrictions are expected to knock out many overseas buyers who could formerly get local loans. For those buyers who have already put down a deposit on an off-the-plan apartment, there is a growing danger they will not be able to get finance to settle the purchase. Combined with the glut of apartments set to flood the market, this additional settlement risk is likely to put severe downward pressure on unit prices. Source: ABC News by business reporter Michael Janda The recent boom in unit construction has seen record-high levels of unit approvals and construction culminating in a substantial volume of new unit stock, much of which will settle over the next 24 months. CoreLogic’s new settlement risk report looks at the number of units due to settle over the next 6, 12, 18 and 24 months. This is based on the expected completion of new developments coupled with the number of units being built in these developments. The first table highlights the number of unit sales over the 12 months to April 2016, the average number of annual unit sales over the five years to April 2016 and the anticipated number of unit completions over the 12 month to April 2017 and 24 months to April 2018. Across the combined capital cities there are 92,102 new units set for completion over the next 12 months with that figure rising to 231,129 over the next 24 months. Number of expected unit settlement, data to April Looking at the expected new unit supply, Sydney and Melbourne predictably have the greatest increases in stock over the next two years. If you compare the volume of stock expected to settle over the next 12 and 24 months to the average number of unit sales annually over the past five years, you can see a big disconnect, particularly in the four largest capital cities. The historic sales figures include sales of both existing and new units keeping in mind that new stock, usually accounts for a smaller slice of total sales than resales of existing stock. The large volume of new stock, coupled with an ever-growing supply of existing stock which resells means that historic high levels of unit settlements are due to occur over the next two years in most cities. In fact, in Melbourne and Brisbane even a recurrence of the peak year for sales over the next two years wouldn’t represent enough demand to cater for all of the new units set to settle over the coming 24 months. The second table highlights the SA3 regions nationally that have the highest number of anticipated unit settlements over the next 24 months. Given the much higher number of unit settlements in Sydney and Melbourne, these cities dominate this list with eight and 12 of the regions listed respectively. In Queensland, three regions from Brisbane and one from the Gold Coast are listed while one Perth region is also listed. SA3 regions nationally with the most expected unit completions over 24 months to Apr-18 If we compare the capital cities, it becomes evident that most of the stock in Melbourne, Brisbane and Perth is located in inner-city (within 10km radius of the city). Taking a look at Sydney, the new unit supply is more geographically diverse. Yes, there are a lot of new units in inner city areas but there are also plenty in outer areas like Parramatta, Strathfield, Auburn and Kogarah-Rockdale. In some respects this spreads some of the risk around the city rather than other cities where new supply is much more centralised. The large volume of new unit settlements over the next two years does raise some potential concerns, namely:

Settlement risk is something that we will be keeping a very close eye on over the coming months and years. Click for full Report Source: CoreLogic RP Data Property Pulse by Cameron Kusher APARTMENT settlements, and the ongoing strength of the national construction boom, are about to be tested over the next 24 months, and according to one forecaster the picture isn't pretty.

The CoreLogic RP Data Property Pulse reveals that sales records will have to be smashed in some markets to avoid a massive glut of supply. The report has identified Brisbane and Melbourne as most at risk of settlement defaults, even though Sydney and Melbourne will have the greatest supply increases of any markets. It also warns that tighter lending rules by banks, particularly for overseas investors, will compound the problem, the first signs of which could emerge in the next few months. The report has revealed that 92,102 new apartments are due for completion in capital city markets over the next 12 months. This will surge to 231,129 over the next 24 months. "Looking at new unit supply across our capitals, Sydney and Melbourne are predicted to have the greatest increases in stock over the next two years," says the report. CoreLogic research analysts Cameron Kusher describes a 'big disconnect' between these numbers and average annual apartment sales over the past five years. "The large volume of new stock, coupled with an ever-growing supply of existing stock means that historic high levels of unit settlements are due to occur over the next two years in most cities," says Kusher. "In fact, even a recurrence of the peak year for sales in Melbourne and Brisbane over the next two years wouldn't represent enough demand to cater for all of the new units set to settle over the coming 24 months." Kusher says most of the stock due to settle in Melbourne, Brisbane and Perth is located within 10km of the CBD. However, he believes Sydney could be shielded to some extent from a potential settlement fallout due to the geographical diversity of projects under way. "In some respects this spreads some of the risk around the city rather than other cities where new supply is much more centralised," says Kusher. The CoreLogic RP Data Property Pulse says the surge in apartment supply is putting the brakes on capital growth in the sector, with house prices rising at a faster rate. "Many off-the-plan unit buyers would have expected a level of capital growth between contract and settlement," says the report. "Mortgage lenders have recently tightened their lending criteria; subsequently some people who have committed to off-the-plan units may not be able to borrow as much as they could at the time of signing the contract. "To compound the situation, three of the four largest banks have announced they will no longer be lending to overseas home buyers which may result in a larger number of contracts not progressing through to settlement, considering a larger proportion of off the plan unit sales are to overseas buyers." Kusher says settlement risk is a trend he will be keeping an eye on in the next few months, and in the year ahead. Source: Business News Australia by Nick Nichols A NEW report has warned that thousands of units set to be settled over the next 24 months face settlement risk.

There are 44,511 apartments set to come online in Brisbane in the next two years. Analysts warn that those who pull out of contracts could still be sued by developers to make up any loss in value of the apartment. The CoreLogic RPData New Settlement Risk Report warned tightening lending conditions and the large volume of new unit settlements over the next two years raised concerns over whether all payments would be able to proceed as planned. “Mortgage lenders have recently tightened their lending criteria; subsequently some people who have committed to off-the-plan units may not be able to borrow as much as they could at the time of signing the contract,” it said. The report warned that three of the four largest banks had already announced they would no longer lend to overseas home buyers, which could result in a larger number of contracts not going through to the settlement phase. In Brisbane last year, 15,880 new units were sold. This year the figure is expected to rise to 16,652. Analysts were closely watching units that had now hit settlement dates, especially in inner-city locations around Brisbane. “With so much stock coming online at once, there is an increasing concern as to whether settlement valuations will actually meet the contract price of these units,” CoreLogic RPData analysts warned. It comes as EPS Property Search director Patrick Bright warned buyers that off-the-plan purchases were speculative investments, given settlement could be delayed by years. “Anything that you buy with a delayed settlement is a risk and the longer the settlement, the greater that risk becomes,” he said. “You’re punting on the fact that the market will go up. If it goes down and it’s worth less at completion than the price you paid, then, when you go to finance that property at settlement you’re in negative equity. “If you end up in this situation, it’s much harder to get the finance and if you can’t secure it, then you will lose your 10 per cent deposit.” Source: The Courier Mail by Sophie Foster, News Corp Australia Network We could be about to see more off-the-plan apartment buyers unable to complete their purchases at settlement in the major capitals, according to new research from CoreLogic RP Data.

The record approval and construction levels of apartments could pose settlement risks in certain areas of the biggest capital cities, particularly where investors are looking to buy off the plan over the next two years. A combination of record construction, tightened lending and the concentration of units due for settlement in similar locations to existing stock could increase the risk of off-the-plan buyers not being able to complete their purchases at settlement. More than 90,000 new apartments are set to be built and completed over the next 12 months, according to CoreLogic RP Data. This figure is expected to rise to more than 230,000 over the next 24 months. By CoreLogic numbers, the volume of new apartments is set to exceed the average number of total apartment sales in the past five years – something CoreLogic research analyst Cameron Kusher describes as a "big disconnect" between supply and demand, particularly in the four biggest capitals. Sydney and Melbourne are predicted to have the greatest stock increases in the next two years – more than 80,000 apartments in each city – although Brisbane and Perth should also both see big spikes in supply during that time. "The large volume of new stock, coupled with an ever-growing supply of existing stock, means that historic high levels of unit settlements are due to occur over the next two years in most cities," Kusher said. "In fact, even a recurrence of the peak year for sales in Melbourne and Brisbane over the next two years wouldn’t represent enough demand to cater for all of the new units set to settle over the coming 24 months.” The inner city regions of Melbourne and Brisbane top the national list of areas with the most expected unit completions between now and April 2018. More apartments are slated to be built over the next 24 months in the inner area of the Queensland capital than even inner Sydney, despite greater Brisbane having less than half the population of greater Sydney. Spreading the riskKusher said that while most of the apartment stock due to settle in Melbourne and Brisbane is concentrated within a 10km radius of the CBD, Sydney's new unit supply is more geographically diverse. He aruged that "in some respects this spreads some of the risk around the city rather than other cities where new supply is much more centralised". Other regions of Sydney among the top 10 nationally for expected new unit completion include Strathfield-Burwood-Ashfield, Parramatta and Ryde-Hunters Hill. All three areas are roughly 10kms or further away from the centre of town. Median unit prices have gone up by more than 4% in Sydney in the four months to 30 April according to CoreLogic, but only 1% in Brisbane. In Melbourne, they've fallen by 0.4%. In April, a report by industry analysts BIS Shrapnel found around 70% of Melbourne's apartment construction boom over the next three years would take place in the CBD, Docklands and Southbank areas. In the same month the Reserve Bank of Australia (RBA) also warned of the risk of a glut of apartments in inner Melbourne and Brisbane, particularly if "demand were to decline significantly". Three of the big four banks recently announced tightening of their lending rules to overseas property buyers, many of whom have historically invested in off-the-plan apartments in inner Sydney and Melbourne. Kusher identified several other concerns for off-the-plan investors raised by the flood of new apartments, including "substantially lower" capital growth in many regions compared with houses as well as the recent tightening of lending criteria, which meant "some people who have committed to off-the-plan units may not be able to borrow as much as they could at the time of signing the contract". Source: Commonwealth Bank of Australia by Sam Butler CoreLogic RP Data's Tim Lawless has noted the mature nature of the Sydney unit market has actually seen houses underperform compared to units, with growth of 8.4 percent and 11.5 percent respectively over the past twelve months.

It is this strong performance from the Sydney unit market which is largely driving the higher growth rate across the combined capitals average. “This growth differential can likely be explained by the higher supply levels of units in the inner city markets of Melbourne and Brisbane,” he added. CoreLogic’s latest Settlement Risk report shows approximately 31,000 apartments are due to settle across Melbourne’s inner city region over the next 24 months, while Inner Brisbane has almost 17,500 units due to settle over the next two years. According to CoreLogic research analysts, settlement risk implies that units sold off the plan could show a valuation at the time of settlement that is lower than the contract price, creating the risk for developers that contracted buyers may look to seek ways in which to avoid completing the contract to purchase the property. Buyers of the off the plan units who find their valuation at the time of settlement is lower than the contract price may face a higher than expected financial outlay as lenders seek to ensure an 80% loan to valuation ratio. "This risk may have been exacerbated in recent weeks with three of the big four banks reportedly limiting the extent to which they are willing to lend to non-residents," Lawless suggests. "Of course non-residents are a material segment of persons buying new units off the plan." CoreLogic reported rental markets have continued along their soft path, with capital city rents holding steady over the month, but down 0.2 percent compared with a year ago. As welling rents are broadly flat at a time when dwelling values continue to rise, rental yields are lower. The gross rental yield for capital city dwellings pushed to a new record low of 3.4 percent in April, while Melbourne’s gross yield profile is even lower, averaging 3.0 percent. “The low yield profile across Australia’s two largest cities, which are also the cities that attract the largest investment demand, suggests that most recent investors, despite the low mortgage rate settings, are likely to be utilising a negative gearing strategy to offset their cash flow losses against their taxable income. "Buyer demand continues to be supported by mortgage rates that are close to historic lows, as well as high levels of investment demand. Even though investor demand has eased since May last year, investors still comprise approximately 46 percent of all new mortgage commitments. "With the likelihood of interest rate increases in the foreseeable future almost non-existent due to the negative March quarter inflation reading, buyer demand is likely to remain high for housing. Similarly, as long as taxation policy continues to support investment in the housing market, we are likely to see investors remain as a substantial component of housing demand due to the lacklustre returns evident in other asset classes such as cash, bonds and equities,” Mr Lawless said. Source: Property Observer by Jonathan Chancellor |

RSS Feed

RSS Feed